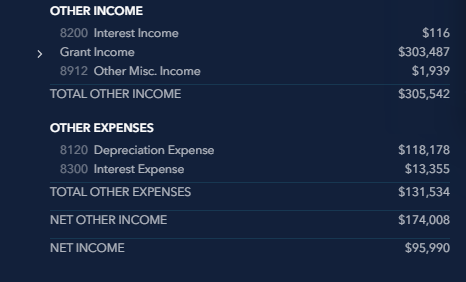

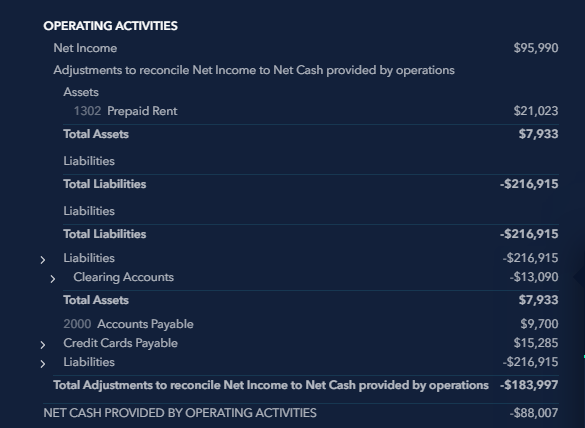

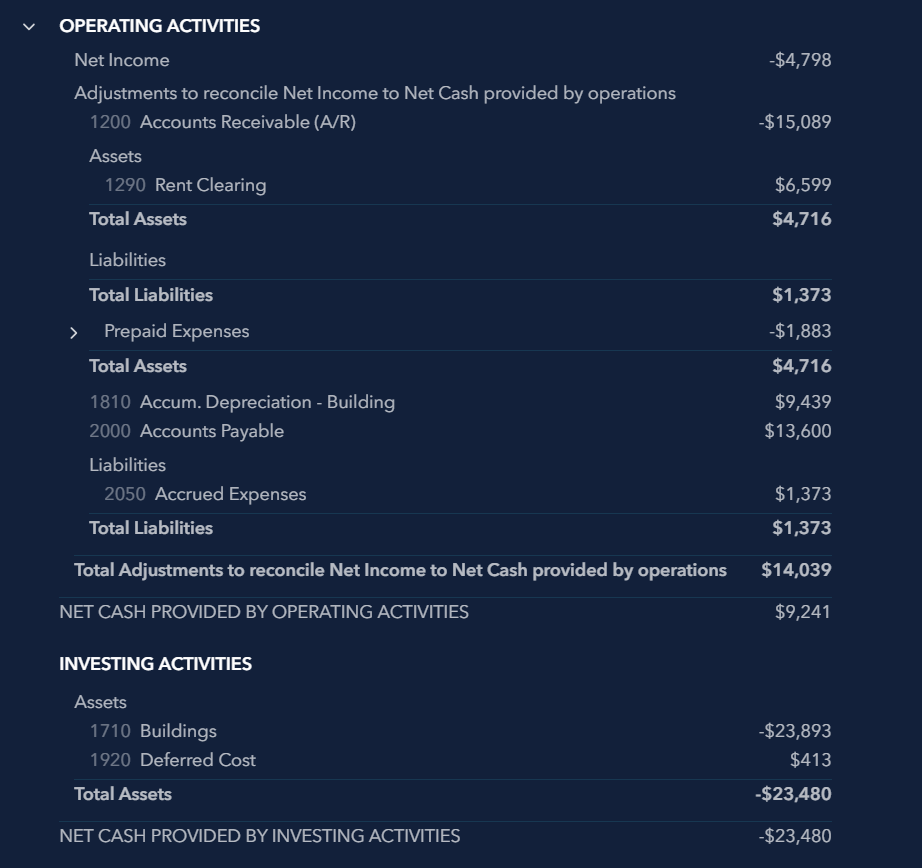

The statement of cash flow shows the net total cash flow correctly, but it does not show the correct cash flow from operating and/or investing. It appears that the net operating cash flow is calculated by taking net income for the period and then adjusting that by the delta of balance sheet account balances to arrive at net cash flow. That is a good first step, however, more is needed to be done in order for the cash flow to be accurate.

Here are some of the scenarios where this would be an issue.

- Assume in Year 1, the only transaction is that the business received an invoice for $100k for an equipment that they purchased and did not pay it until Year 2 and the business has zero net income. In Year 1, the only entry would be Dr. Fixed Asset $100k Cr. Accounts Payable $100k. With this scenario, would the cash flow reports here show that the Net Cash Flow from Operating as a positive $100k (zero net income plus the increase in Accounts Payable)? If yes, did this business generated $100k in operating cash flow simply by entering an invoice for equipment purchase into AP? Surely not.

- It appears that “Cash Flow from Investing Activity” is simply the delta between Long Term Asset account balances. The Cash Flow report picks up the change in Accumulated Depreciation (a Long Term Asset Account) as a positive net cash flow from investing activities. Often times, the change in Accumulated Depreciation is depreciation expense. Did the business really generated positive cash flow from investing activities simply because they had depreciation expense or should the depreciation expense be an adjustment to Net Income to arrive at Net Cash Flow from Operating Activities?

- How does the cash flow report adjust for other non-operating income such as gains from sale of equipment, dividends or investment income, other comprehensive income, PPP loan forgiveness etc from cash flow from operating activities?